The Only Guide for Home Renovation Loan

The Only Guide for Home Renovation Loan

Blog Article

Our Home Renovation Loan Ideas

Table of ContentsAbout Home Renovation LoanHome Renovation Loan for DummiesWhat Does Home Renovation Loan Do?About Home Renovation LoanAll About Home Renovation LoanThe 9-Second Trick For Home Renovation Loan

If you are able to access a reduced home mortgage rate than the one you have currently, refinancing might be the very best choice. By utilizing a home loan re-finance, you can possibly free the funds needed for those home renovations. Super Brokers home loan brokers do not bill costs when in order to offer you funding.This saves you from having to supply these funds out of your own pocket. Super Brokers home loans have semi-annual compounding. This means that your passion will certainly be intensified two times each year. Also better, payment options depend on you most of the times. These payments can be made month-to-month, semi-monthly, bi-weekly, bi-weekly increased, and weekly.

The 8-Second Trick For Home Renovation Loan

Charge card passion can intensify quickly which makes it considerably harder to repay if you aren't certain that you can pay it off quickly (home renovation loan). Despite having limited-time low rates of interest offers, bank card passion rates can climb. Typically, charge card interest rates can strike around 18 to 21 percent

Unlike typical mortgage or individual financings, this type of financing is customized to attend to the costs associated with home remodeling and renovation tasks. It's a wonderful choice if you wish to boost your home. These loans come in useful when you intend to: Improve the visual appeals of your home.

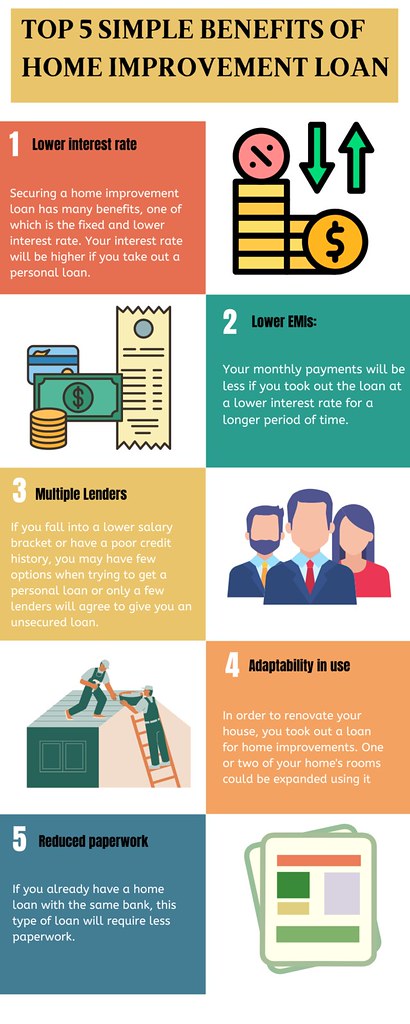

Boost the total value of your home by updating areas like the kitchen, washroom, and even including brand-new rooms. A Renovation finance can have numerous advantages for borrowers. These can include: This indicates that the lending quantity you qualify for is established by the forecasted rise in your building's worth after the improvements have actually been made.

Home Renovation Loan - The Facts

That's because they commonly include lower rate of interest rates, longer repayment durations, and the potential for tax-deductible rate of interest, making them a much more cost-efficient service for funding your home enhancement go now remodellings - home renovation loan. A Renovation car loan is excellent for house owners that desire to change their space since of the adaptability and advantages

There are several reasons that a house owner might wish to obtain a restoration car loan for their home enhancement project. -Undertaking restorations can significantly boost the value of your residential property, making it a smart investment for the future. By improving the aesthetic appeals, performance, and overall allure of your home, you can expect a greater return on financial investment when you make a decision to market.

This can make them a more cost-efficient method to finance your home renovation jobs, reducing the general financial problem. - Some Home Remodelling fundings provide tax obligation reductions for the passion paid on the finance. This can help in reducing your taxable earnings, providing you with added savings and making the loan a lot more budget-friendly in the future.

Home Renovation Loan Fundamentals Explained

- If you have multiple home renovation projects in mind, a Restoration funding can aid you consolidate the costs right into one workable loan repayment. This permits you to improve your finances, making it less complicated to keep an eye on your costs and budget plan properly. - Restoration car loans usually come with versatile terms and settlement alternatives like a 15 year, 20 year, or 30 year car loan term.

- A well-executed improvement or upgrade can make your home extra appealing to potential purchasers, improving its resale capacity. By purchasing top notch upgrades and improvements, you can bring in a wider array of possible buyers and boost the probability of safeguarding a beneficial sale rate. When considering a restoration car loan, it's essential to comprehend the various alternatives available to locate the one that best suits your demands.

Equity is the difference between your home's present market value and the quantity you still owe on your home mortgage. Home equity finances usually have dealt with rates of interest and settlement terms, making them a predictable option for property owners. is comparable to a credit card because it gives a rotating credit line based on your home's equity.

After the draw period finishes, the payment phase starts, and you must settle the obtained amount with time. HELOCs commonly feature variable rate of interest rates, which can make them less foreseeable than home equity financings. is next a government-backed mortgage insured by the Federal Real estate Management that combines the cost of the home and improvement costs into a single financing.

The 3-Minute Rule for Home Renovation Loan

With a reduced down settlement requirement (as low as 3.5%), FHA 203(k) loans can be an appealing option for those with restricted funds. another choice that allows consumers to finance both the purchase and improvement of a home with a solitary mortgage. This car loan is backed by Fannie Mae, a government-sponsored venture that provides home mortgage funding to lenders.

In enhancement, Title I car loans are readily available to both house owners and property owners, making them a flexible choice for different circumstances. A Lending Officer at NAF can answer any concerns you have and help you understand the different types of Home Renovation loans readily available. They'll additionally assist you find the click for info very best alternative matched for your home enhancement needs and financial situation.

If you're looking to make energy-efficient upgrades, an EEM may be the ideal option for you. On the other hand, if you're an expert and intend to purchase and restore a fixer-upper, a VA Restoration Financing might be a perfect selection. There are numerous steps involved in protecting a home renovation financing and NAF will certainly assist lead you with every one of them.

The Buzz on Home Renovation Loan

- Your credit history rating plays a considerable role in protecting an improvement funding. It influences your finance qualification, and the interest rates lenders use.

A higher credit report might lead to much better financing terms and lower rate of interest. - Assemble essential files that loan providers need for finance authorization. These may include proof of earnings, income tax return, debt background, and in-depth information about your renovation task, such as service provider estimates and blueprints. Having these files ready will certainly accelerate the application process.

Report this page